Essential Checking No monthly service fee and top notch mobile banking

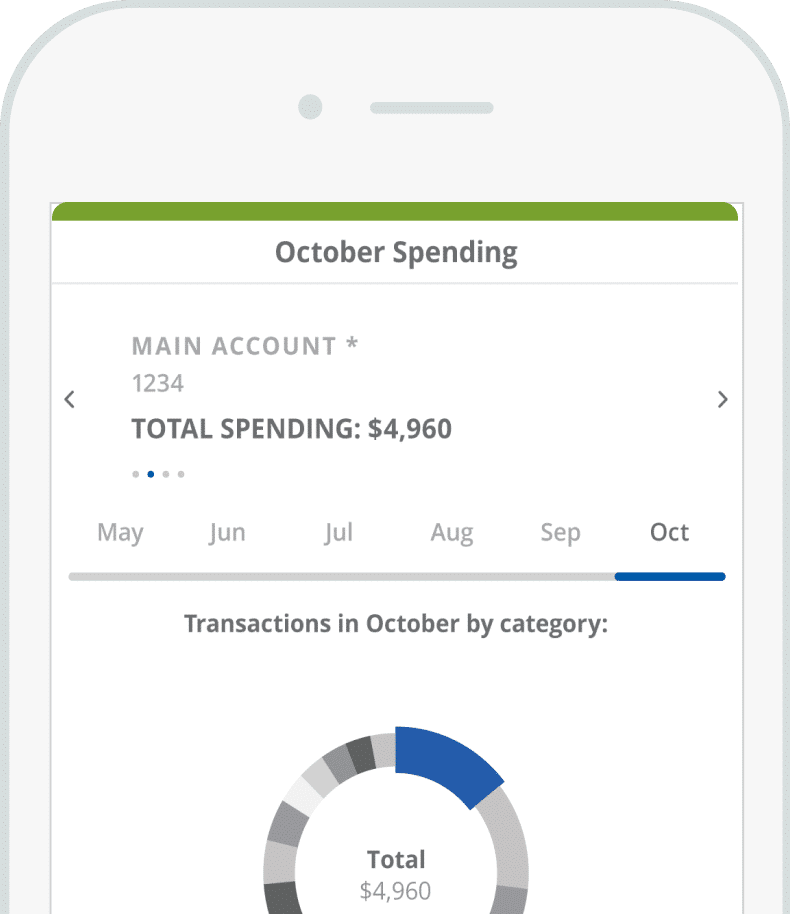

Limited Time Offer – Get up to $150* when you open a new Essential Checking account. Plus get paid up to two days early with Early Payday and experience our Mobile App with Zelle®, AI powered insights and more.

Looking for a Better Fit?

FutureTrack We Love to Save Blog

Disclaimers

1 No $3 monthly service fee when primary owner of Essential Savings account is an owner of an Essential Checking account; or if the primary owner of Essential Savings account is 18 years of age or younger or 60 years of age or older; or maintain a $300 minimum daily balance.

2 Non-USB ATM transaction fee waived up to 6 times per statement cycle for ages 15-24 (age based on primary owner).

If account becomes overdrawn, fees may be assessed. Please see our Schedule of Interest and Deposit Account Charges or call 866.872.1866 for further information.

Zelle and the Zelle related trademarks are wholly owned by Early Warning Services, LLC and are used herein under license. Terms and conditions apply.

If account becomes overdrawn, fees may be assessed. Please see our Schedule of Interest and Deposit Account Charges or call 866.872.1866 for further information.