Get up to $600 when you open an Access checking account*

Get up to $600 when you open an Access checking account*

Access Checking Account Features

- Free, unlimited ATM transactions

- Access to Zelle® – quickly and easily send money to friends, for free in our app.

- Early Payday gets you paid up to two days earlier

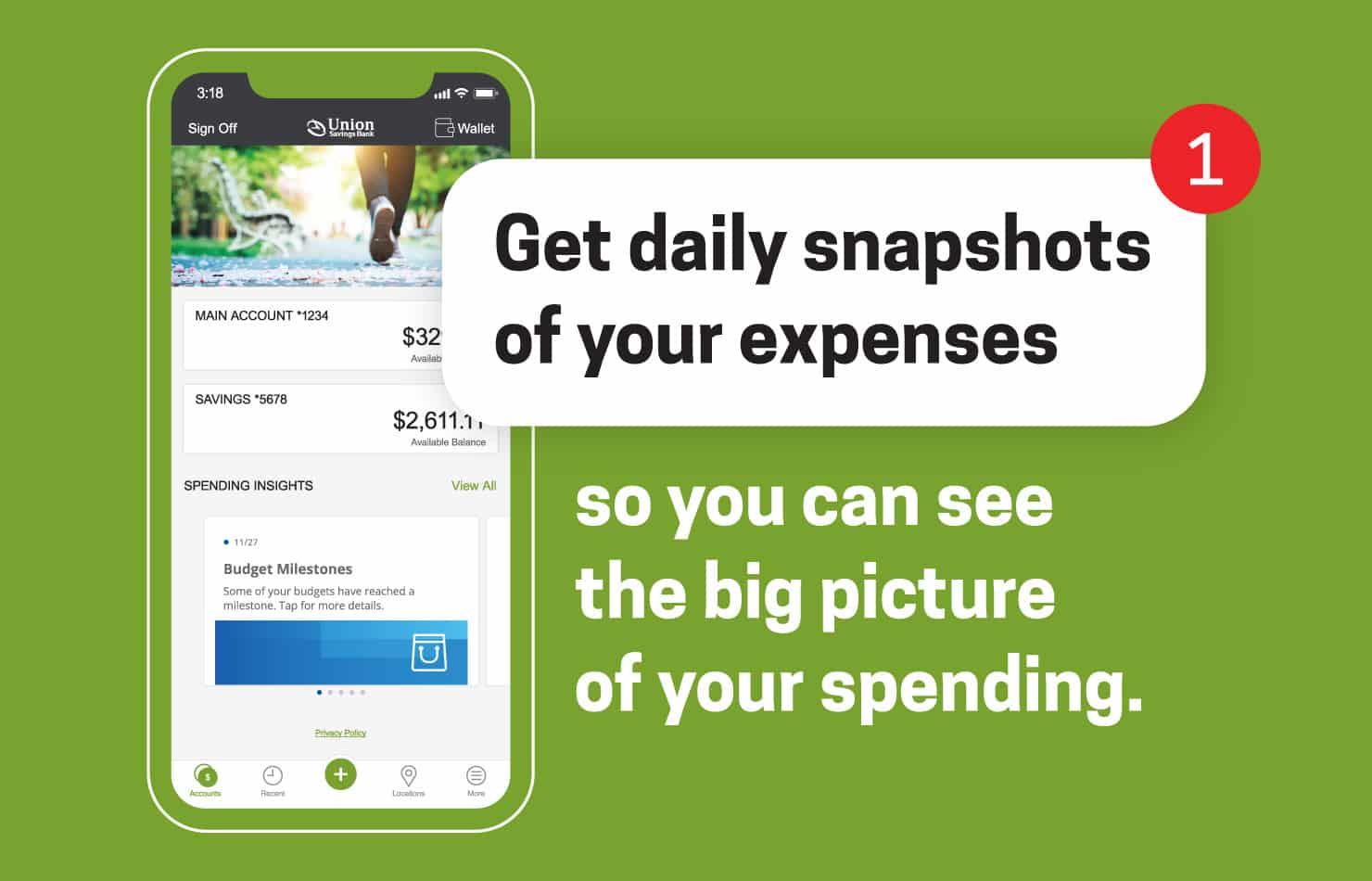

- Spending Insights – analyzes your spending to make budgeting easier

- Earn interest on your balance

- $0 monthly service fee1

- Contactless USB Debit Card (get it right away at a branch!)

- Real-time fraud monitoring and alerts for your contactless USB Debit Card

- Debit card controls within the USB Mobile App so you can control spending, review transactions, and reduce the chance of fraud

- $0 monthly service fee Access Savings account 2

- USB Online Banking with Bill Pay

- Mobile check deposit with the USB Mobile App

- Digital Wallets can be linked to your USB Debit Card

- Free paperless eStatements

- Free paper statement

- Always excellent customer service

Or visit a branch or call us at 866.872.1866

USB Spending Insights: Helping you know when you can spend and when you should save.

$0 Monthly Service Fee

When You Meet Any of the Following Criteria:

- Maintain a minimum balance of $5,000 OR

- Maintain combined deposit balances of $25,000, OR

- Maintain combined deposit and loan balances of $50,000. Loan balances include consumer and residential mortgage loans.

Manage your bank account with ease

With USB Digital Banking Tutor, you can learn how to use our online and mobile banking products so you can better manage your finances wherever you are, anytime you want.

Looking for a Better Fit?

Your Future Starts Now

We can help you focus on your financial journey, whether you’re just getting started or well on your way. Future Track can help you get thinking, but come in and see us – we’ll discuss your goals and help you reach them.

FutureTrack We Love to Save Blog

USB Rates

- Annual Percentage Yield (APY)**

- $0.01 - $4,999.99

- 0.03%

- $5,000.00 - $24,999.99

- 0.03%

- $25,000.00 - $49,999.99

- 0.04%

- $50,000.00 - $99,999.99

- 0.06%

- $100,000.00+

- 0.08%

- Interest Rate

- $0.01 - $4,999.99

- 0.03%

- $5,000.00 - $24,999.99

- 0.03%

- $25,000.00 - $49,999.99

- 0.04%

- $50,000.00 - $99,999.99

- 0.06%

- $100,000.00+

- 0.08%

- Frequency of Rate Change***

- Variable

- Interest Compounding

- Monthly

- Interest Credited

- Monthly

- Minimum Balance to Open Account

- $50.00

- Minimum Balance to Earn APY

- $0.01

Disclaimers

1 There are 3 ways to waive the monthly service fee: maintain a minimum balance of $5,000, combined deposit balances of $25,000, or combined deposit and loan balances of $50,000. Loan balances include consumer and mortgage loans.

2 No $5 monthly service fee when primary owner of Access Savings account is an owner of Access Checking account.

* To receive up to $150 bonus, open a new Essential Checking account (subject to approval) and deposit $25 or more at account opening; or open a new Core Checking account (subject to approval) and deposit $10 or more at account opening. Get $50.00 if you make one qualifying direct deposit within 60 days of opening the account; and/or get $50.00 when you open a USB Debit Card and make 10 debit card purchases (signature or PIN) within 60 days of opening the account. ATM transactions do not qualify. Qualifying direct deposits include recurring electronic deposits of payroll, pension or Social Security. Person-to-person, bank transfers or other electronic money transfers, such as those made through internet payment services, do not qualify. Additionally, get $50 when you open an Essential Savings Account at the same time as the checking account, and maintain a $500 average balance or more for 90 days from the date of account opening. New USB savings customers only.

To receive up to $600 bonus, open a new Access Checking account (subject to approval) and deposit $50 or more at account opening. Get $300.00 if you make one qualifying direct deposit within 60 days of opening the account. Qualifying direct deposits include recurring electronic deposits of payroll, pension or Social Security. Person-to-person, bank transfers or other electronic money transfers, such as those made through internet payment services, do not qualify. Additionally, get $300.00 when you open a companion Access Savings account at the same time as the checking account and maintain an average balance of $15,000 or more for 90 days from the date of account opening. New USB savings customers only.

Offer is valid from July 24, 2024 through October 16, 2024. New USB personal checking customers only. Limit one per household. Promotion may be canceled without notice. Bonus amounts will be credited to checking and/or savings account between September 24, 2024, and January 31, 2025, depending on the date you open the account. Account must be open and in good standing to receive bonus. Bonuses are subject to 1099 IRS reporting requirements. Employees of Union Savings Bank are not eligible.

**Rates may change after the account is opened

Zelle and the Zelle related trademarks are wholly owned by Early Warning Services, LLC and are used herein under license. Terms and conditions apply.

Account becomes overdrawn, fees may be assessed. Please see our Schedule of Interest and Deposit Account Charges or call 866.872.1866 for further information.