Feel like a financial superhero!

Get up to $600 or $150*

when you open a new checking account

Learn more

Offer is valid from

July 24, 2024 through October 16, 2024

Feel like a financial superhero!

Get up to $600 or $150*

when you open a new checking account

Learn more

Offer is valid from

July 24, 2024 through October 16, 2024

- ACCESS CHECKING

- ESSENTIAL CHECKING

- CORE CHECKING

Not sure where to begin?

Let's compare accounts.

- ACCESS CHECKING

- ESSENTIAL CHECKING

- CORE CHECKING

- Minimum Opening Balance

- $50

- $25

- $10

- Service Fee Per Statement Cycle

- $201

- $5

- Earns Interest On Your Balance

- eStatements

- 2

- 2

- Online Banking with Bill Pay

- USB Mobile App

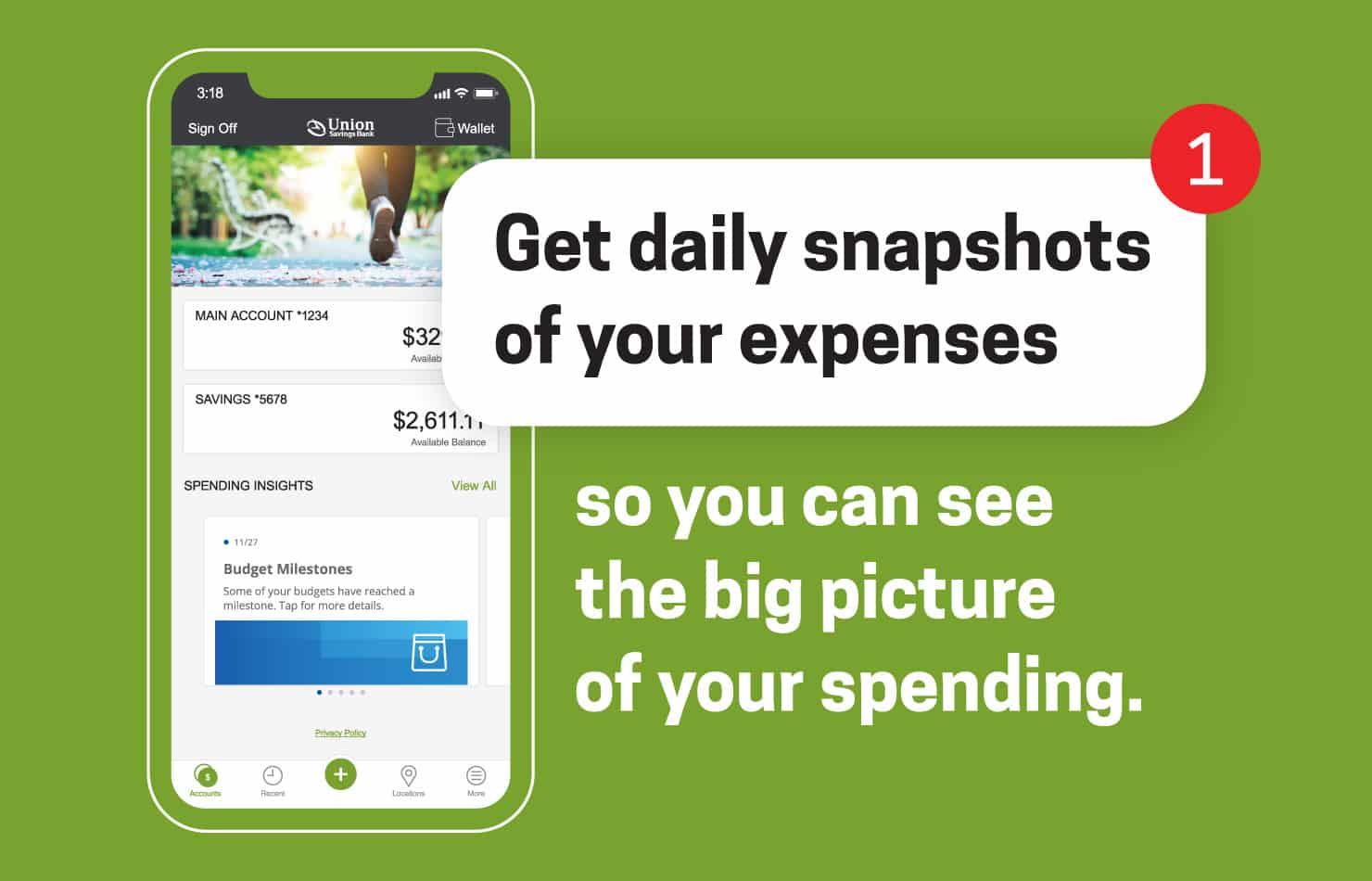

- USB Spending Insights in the Mobile App

- Early Payday

- ATM Transaction Charges

- USB ATMs

- No charge

- No charge

- No Charge

- Non-USB ATMs

- Unlimited

- $2 per transaction

USB fee waived up to 6 times per statement cycle for ages 15-24³ - $2 per transaction

- $0 monthly service fee Access Savings account

- 4

- $0 monthly service fee Essential Savings account

- 5

- 5

- Contactless USB Debit Card

- 6

- 6

- 6

- Check writing and withdrawals per month

- Unlimited

- Unlimited

- Unlimited

- FDIC Insurance

- 7

- 7

- 7

- Overdraft Protection

- 8

- 8

- Direct Deposit

- Apple Pay

- Android Pay

- Samsung Pay

- Visa Click to Pay

- USB Visa Credit Cards

- 9

- 9

- 9

Add a Personal contactless Debit Card to your account. It’s free to have, and easy to use.

The best bank checking account should always include a personal debit card. Because when you add a personal debit card to your account, not only is it easy to get cash from an ATM, but also easy to pay for everyday purchases without having to reach for cash or your checkbook. You can also use your USB Debit Card within a digital wallet for even greater convenience. Click here for additional information.

Contactless USB Debit Cards

- Real-time fraud monitoring and alerts for your contactless USB Debit Card

- Use Debit Card Controls within the USB Mobile App so you can shut your card off if lost, control spending and reduce chance of fraud. View interactive demo

- Instantly receive a new card in the branch; if you can’t get to a branch, your card will be available in USB Mobile to immediately add and use in Apple Pay

USB Spending Insights: Helping you know when you can spend and when you should save.

Manage your bank account with ease

With USB Digital Banking Tutor, you can learn how to use our online and mobile banking products so you can better manage your finances wherever you are, anytime you want.

Personal Banking FAQs

Is there a minimum balance to avoid a service fee on my personal checking account?

There is a minimum balance requirement to waive the monthly service fee for Access Checking. Essential Checking has no monthly fees.

What is an overdraft?

An overdraft occurs when there’s not enough money in your account to cover a transaction, such as an ATM cash withdrawal or a debit card purchase at a store. At our discretion, we may decide to pay the check or process the transaction even without sufficient funds available. In some cases, your check will be returned or your transaction will be denied. If we do decide to process transactions that overdraw your account, you will be charged a fee for each item, unless you have one of our alternate overdraft services.

What do I do if my USB Debit Card is lost or stolen?

In the event your USB Debit Card is lost or stolen, please call 866.872.1866 immediately to report your card is missing.

What fees will I be charged if Union Savings Bank pay my overdraft?

There is no fee to enroll in the Opt-In service. There are only fees incurred if/when you use the service and those are as follows:

• We will charge you a fee of $36.00 each time we pay an overdraft, not to exceed 4 overdrafts per day ($144.00)

• Consult our Schedule of Interest and Deposit Account Charges for current deposit fee information

Your Future Starts Now

We can help you focus on your life stage financial planning journey, whether you’re just getting started or well on your way. Our FutureTrack website can help you get thinking, so check it out. And when you’re done, come in and see us – we’ll discuss your goals and help you find the right financial and retirement plan to make your dreams come true.

USB Rates

- Annual Percentage Yield (APY)**

- $0.01 - $4,999.99

- 0.03%

- $5,000.00 - $24,999.99

- 0.03%

- $25,000.00 - $49,999.99

- 0.04%

- $50,000.00 - $99,999.99

- 0.06%

- $100,000.00+

- 0.08%

- Interest Rate

- $0.01 - $4,999.99

- 0.03%

- $5,000.00 - $24,999.99

- 0.03%

- $25,000.00 - $49,999.99

- 0.04%

- $50,000.00 - $99,999.99

- 0.06%

- $100,000.00+

- 0.08%

- Frequency of Rate Change***

- Variable

- Interest Compounding

- Monthly

- Interest Credited

- Monthly

- Minimum Balance to Open Account

- $50.00

- Minimum Balance to Earn APY

- $0.01

Disclaimers

Account becomes overdrawn, fees may be assessed. Please see our Schedule of Interest and Deposit Account Charges or call 866.872.1866 for further information.

1 There are 3 ways to waive the monthly service fee: maintain a minimum balance of $5,000, combined deposit balances of $25,000, or combined deposit and loan balances of $50,000. Loan balances include consumer and mortgage loans.

2 There is no charge for eStatements. Paper statement fee is waived for primary owner 60 years or older. Paper Statement fee is $3 for Essential Checking and $2 for Core Checking.

3 Non-USB ATM transaction fee waived up to 6 times per statement cycle for ages 15-24 (age based on primary owner).

4 No $5 monthly service fee when primary owner of Access Savings account is an owner of Access Checking account.

5 No $3 monthly service fee when primary owner of Essential Savings account is an owner of Essential Checking or Core Checking account; account subject to $3 monthly paper statement fee if primary owner is under 60 years of age.

6 Card will be issued to an individual age 15 years or older for joint accounts (accounts titled jointly with an adult parent or guardian).

7 Deposits are insured up to FDIC limits. Click here for FDIC calculator.

8 Overdraft protection options include automated savings transfers and Overdraft Protection Line of Credit. Subject to credit approval. Customers must be 18 years or older or have an adult listed on the account to apply for an Overdraft Protection Line of Credit. This does not apply to Health Savings or Bank On accounts as overdrafts are prohibited. Visit www.unionsavings.com or call 866.872.1866 for further information.

9 The creditor and issuer of these Cards is Elan Financial Services. Separate credit application and credit approval required.

Separate enrollment in Digital Wallets is required.

Apple Pay is a trademark of Apple Inc. Google Pay is a registered trademark of Google Inc. Samsung Pay is a registered trademark of SAMSUNG. Visa Checkout © 2018 Visa. All Rights Reserved.

* To receive up to $150 bonus, open a new Essential Checking account (subject to approval) and deposit $25 or more at account opening; or open a new Core Checking account (subject to approval) and deposit $10 or more at account opening. Get $50.00 if you make one qualifying direct deposit within 60 days of opening the account; and/or get $50.00 when you open a USB Debit Card and make 10 debit card purchases (signature or PIN) within 60 days of opening the account. ATM transactions do not qualify. Qualifying direct deposits include recurring electronic deposits of payroll, pension or Social Security. Person-to-person, bank transfers or other electronic money transfers, such as those made through internet payment services, do not qualify. Additionally, get $50 when you open an Essential Savings Account at the same time as the checking account, and maintain a $500 average balance or more for 90 days from the date of account opening. New USB savings customers only.

To receive up to $600 bonus, open a new Access Checking account (subject to approval) and deposit $50 or more at account opening. Get $300.00 if you make one qualifying direct deposit within 60 days of opening the account. Qualifying direct deposits include recurring electronic deposits of payroll, pension or Social Security. Person-to-person, bank transfers or other electronic money transfers, such as those made through internet payment services, do not qualify. Additionally, get $300.00 when you open a companion Access Savings account at the same time as the checking account and maintain an average balance of $15,000 or more for 90 days from the date of account opening. New USB savings customers only.

Offer is valid from July 24, 2024 through October 16, 2024. New USB personal checking customers only. Limit one per household. Promotion may be canceled without notice. Bonus amounts will be credited to checking and/or savings account between September 24, 2024, and January 31, 2025, depending on the date you open the account. Account must be open and in good standing to receive bonus. Bonuses are subject to 1099 IRS reporting requirements. Employees of Union Savings Bank are not eligible.

**Rates may change after the account is opened

***Visa’s Zero Liability Policy covers U.S. Visa issued cards and does not apply to certain commercial card transactions or any transactions not processed by Visa. You must notify Union Savings Bank immediately of any unauthorized use. If determined that the unauthorized transactions occurred because of your gross negligence or fraud, the special limitations on liability may not apply. To access Visa’s Zero Liability Policy click here.